Exploring Mito’s Constant Product Market Maker (CPMM) trading strategy

Mito brings a diverse range of vaults with sophisticated automated strategies.

In this piece, we will explore the Constant Product Market Maker (CPMM) strategy, a core element engineered to streamline DeFi participation for users across diverse experience levels and financial backgrounds.

While this strategy is commonly utilized by AMM exchanges, it has been innovatively reenvisioned on Mito to combine the user-friendly simplicity of an AMM, with the power of a fully on-chain orderbook.

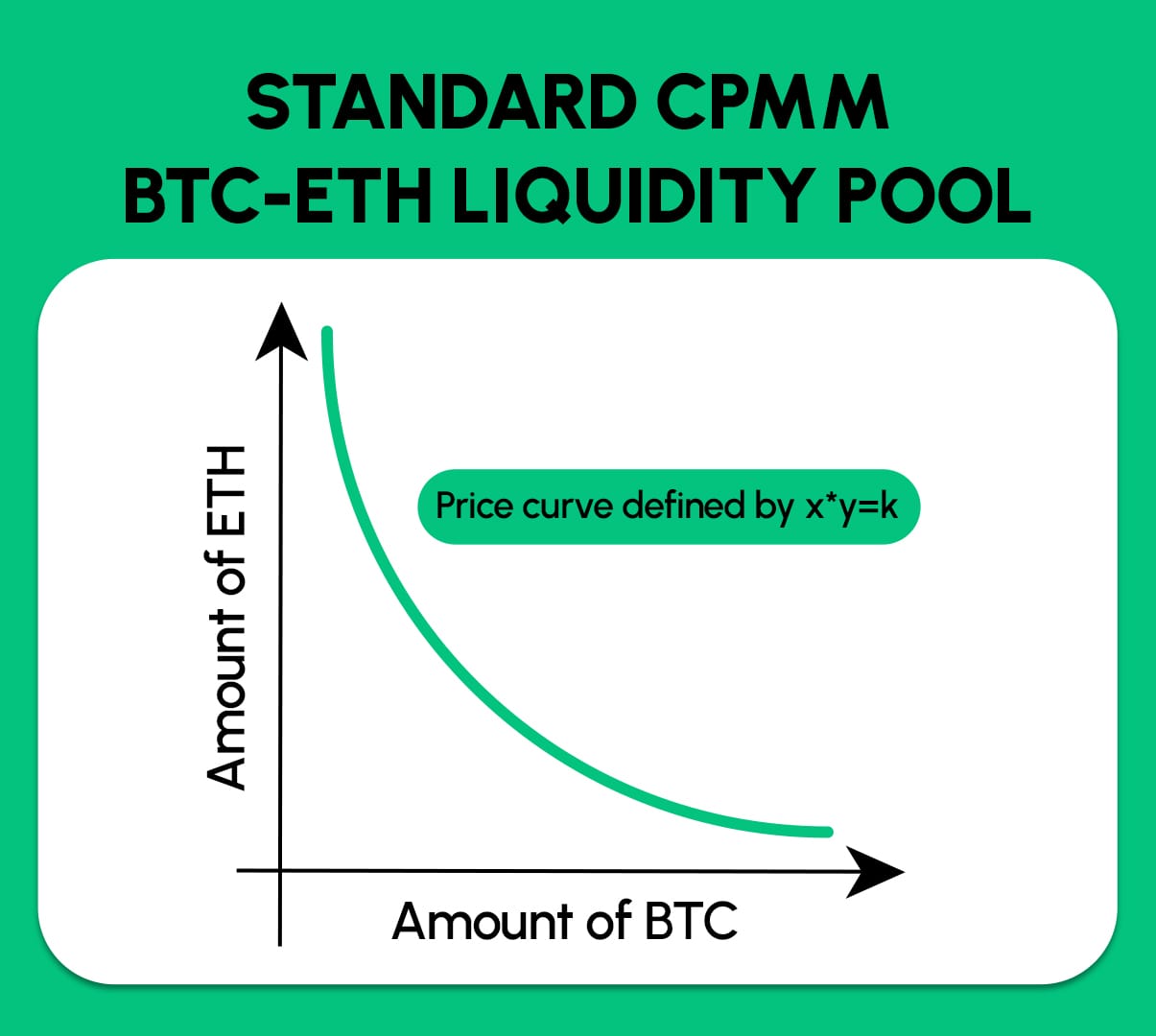

The Original CPMM Liquidity Model

Using a simple formula, the original CPMM liquidity model automatically matches a market’s buyer and seller without the need for a central authority or middleman.

Anyone can contribute to this system by depositing pairs of digital assets into a shared pool. This creates “liquidity”, which acts as the counterparty for the traders between these two assets.

This system automatically adjusts prices of the two digital assets based on the supply and demand. Over time, in return for their liquidity, contributors earn fees from any trading activity in the pool, which are distributed in proportion to their percent ownership of the pool.

Users familiar with this traditional type of liquidity may have seen it represented as a “continuous curve” between the two paired assets [depicted below].

Innovations of the Mito CPMM Automated Vaults

Core Concept

Mito mimics the traditional CPMM model, but reimagines it within a discrete orderbook setting by using strategically placed bid and ask orders.

Mechanism and Flow

- Divide the asset price range into discrete orders instead of a continuous curve.

- Dynamically place these discrete bid/ask orders based on price deviation from a target price.

- Limit the liquidity deployment to a certain range around the target price.

- As asset prices move, remove previous out-of-range orders to the new target price.

- Collect and compound any earnings from market-maker fees.

Example

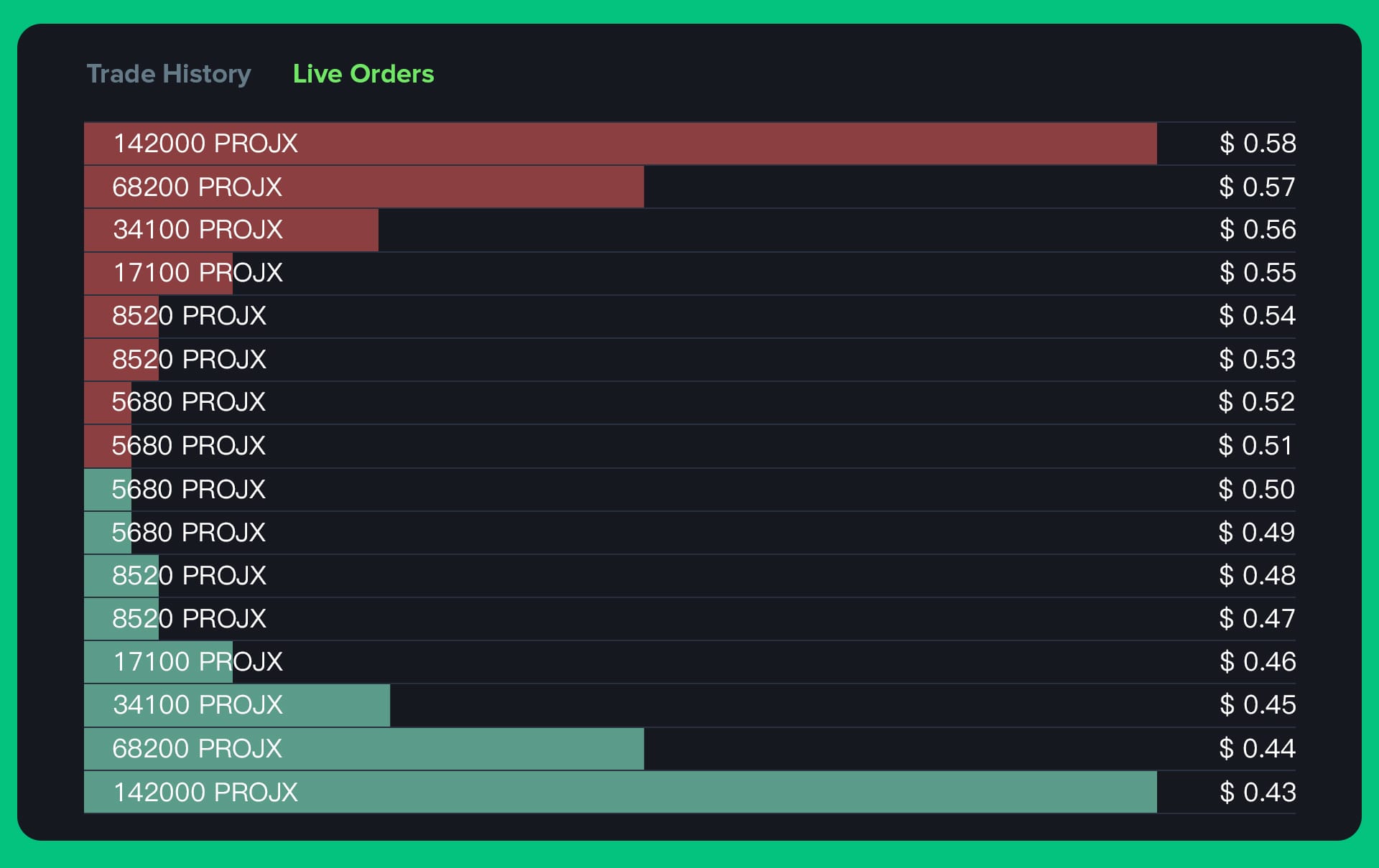

Project PROJX partners with Mito for a CPMM PROJX-USDT vault, initially setting the PROJX token price at $0.50. Project PROJX then contributes 2000 PROJX and 1000 USDT tokens to seed liquidity and establish the initial market.

When users deposit to this newly-created Mito vault, the vault will strategically place orders on the Injective orderbook. In this case, there will be buy orders below $0.50 and sell orders above $0.50, with the order range, or target price deviation, determined by the vault specifications. This order range then creates a price buffer around the $0.50 target price for PROJX, which potentially attracts arbitrage traders looking for opportunities when prices move.

The Benefits of Mito CPMM Automated Vaults

Easy to use and manage

Even for DeFi beginners, the vaults are simple to use and do not require active management after deposit. It also creates a familiar environment for those who may be unfamiliar with orderbook exchanges, but want to utilize the full capabilities of a decentralized orderbook exchange.

Potential Portfolio Returns

Vaults may potentially help users generate returns on their DeFi investments, especially when staked in Mito’s Reward feature with additional INJ incentives.

Diversification and Stability

Vaults offer a simple way to diversify your digital asset portfolio, potentially mitigating concentration risks. Furthermore, vaults that include stablecoin assets can offer more price stability as half of the initial deposit is pegged to $1.

Support the Injective Ecosystem

Vaults contribute to the growth and stability of the Injective ecosystem by providing much-needed liquidity for nascent protocols.

Conclusion

Mito’s new automated vaults offer a simple and convenient way for users to participate in DeFi yielding. Furthermore, when contributing their liquidity, these users are strengthening the overall Injective ecosystem by creating a more efficient and profitable system for both traders and yielders alike.

And the CPMM vaults are just the start!

Stay tuned to the Mito socials and join the growing Mito community to learn more about all of the upcoming automated vaults coming soon.

This post is for informational purposes only and is not financial advice or an endorsement of any project or application.

About Mito

Mito is a groundbreaking Web3 protocol that aims to reshape the future of DeFi automated trading, launchpads, and real-world assets. A combination of automated trading vaults and a launchpad, Mito is powered by smart contracts to simplify crypto trading for all users.

Mito is built on Injective.